Percentage taken out of paycheck

What is the percentage that is taken out of a paycheck. The amount of FICA taxes withheld will vary because its not a set amount but a percentage of your paycheck.

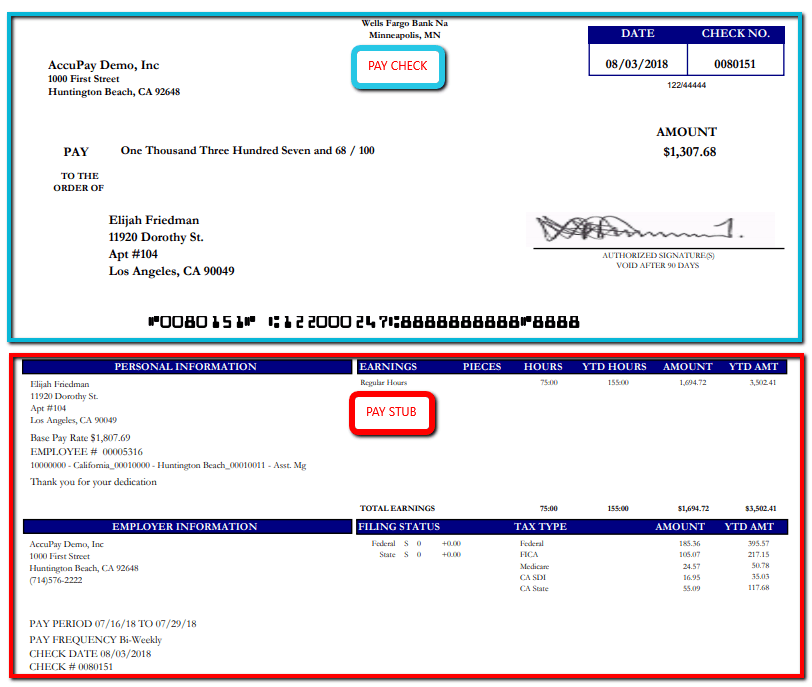

A Guide On How To Read Your Pay Stub Accupay Systems

The federal government requires that you pay 62 percent of your gross pay for FICA taxes and one-half of your Medicare taxes.

. To calculate a paycheck start with the annual salary amount and divide by the number of pay periods in the year. There is a wage base limit on this tax. For a single filer the first 9875 you earn is taxed at 10.

So your big Texas paycheck may take a hit when your property taxes come due. Current FICA tax rates The current tax rate for social security is 62 for the employer and 62 for the employee or. In other words for every 100 you earn you actually receive 6760.

To calculate an annual salary multiply the gross pay before tax deductions by the number of pay periods per year. This number is the gross pay per. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes.

Social Security tax is 62 and Medicare is 145 totaling 765. The Magnolia States tax system is progressive so taxpayers who earn more can expect to pay higher marginal rates of their income. You will be taxed 3 on any earnings between 3000.

However they dont include all taxes related to payroll. From each of your paychecks 62 of your earnings is deducted for Social Security taxes which your employer matches. This is divided up so that both employer and employee pay 62 each.

If you want to boost your paycheck rather than find tax. The current rate for. On the state level you can claim allowances for Illinois state income taxes on Form IL-W-4.

These taxes are deducted from your paycheck in fixed percentages. Social Security tax. The next 30249 you earn--the amount from 9876 to 40125--is taxed at 15.

The federal government receives 124 of an employees income each pay period for Social Security. You pay the tax on only the first 147000 of your. How You Can Affect Your Texas Paycheck.

For example if an employee earns 1500 per week the individuals. The other 3240 is taken. The employer portion is 15 percent and the.

FICA taxes are commonly called the payroll tax. Your contributions will come out of your earnings before payroll taxes are applied. This gives you your take home pay as a percentage of gross pay per pay period.

FICA taxes consist of Social Security and Medicare taxes. 62 of each of your paychecks is withheld for Social Security taxes and your employer contributes a further 62. Also Know how much in taxes is taken out of my paycheck.

How do I complete a paycheck calculation. What percentage is deducted from paycheck. Your employer will withhold money from each of.

Ad Simplify Upgrade Enjoy Easy Payroll Tailored To Your Needs. For the 2019 tax year the maximum. Compare and Find the Best Paycheck Software in the Industry.

Only the very last 1475 you earned. The current tax rate for social security is 62 for the employer and 62 for the employee or 124 total. If your company has an HR department you can schedule a meeting to discuss your options.

Understanding What S On Your Paycheck Xcelhr

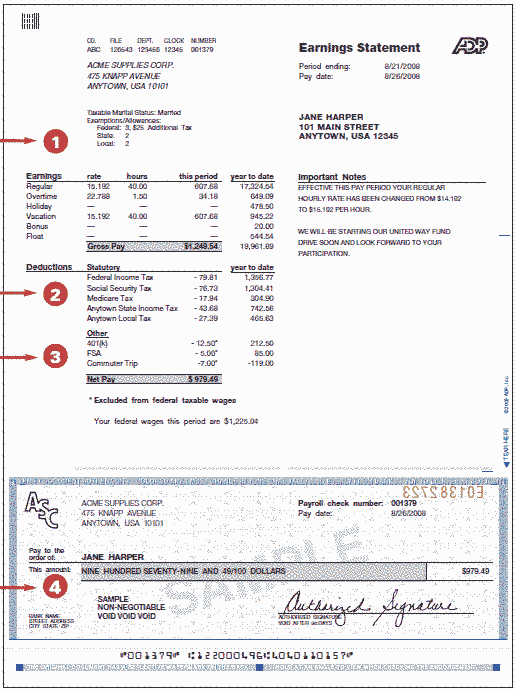

Sample Pay Check And Fica Taxes Savings For Cpt Opt Studetns

What Exactly Gets Taken Out Of Your Paycheck Tax Deductions Paycheck Payroll

Free Online Paycheck Calculator Calculate Take Home Pay 2022

Free Printable Paycheck Stub Templates Pay Template Canada Inside Free Pay Stub Template Word Cumed O Word Template Payroll Template Templates Printable Free

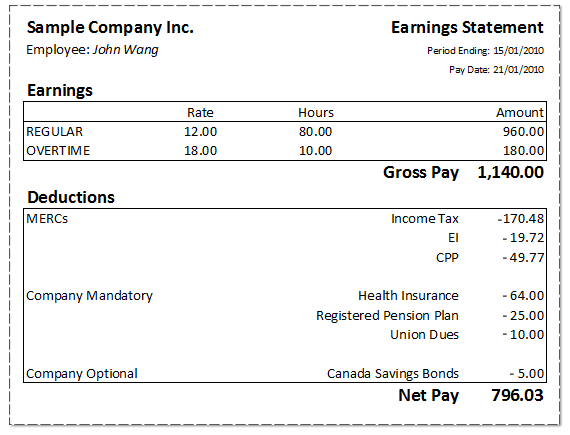

Gross Vs Net Pay What S The Difference Between Gross And Net Income Ask Gusto

Paycheck Taxes Federal State Local Withholding H R Block

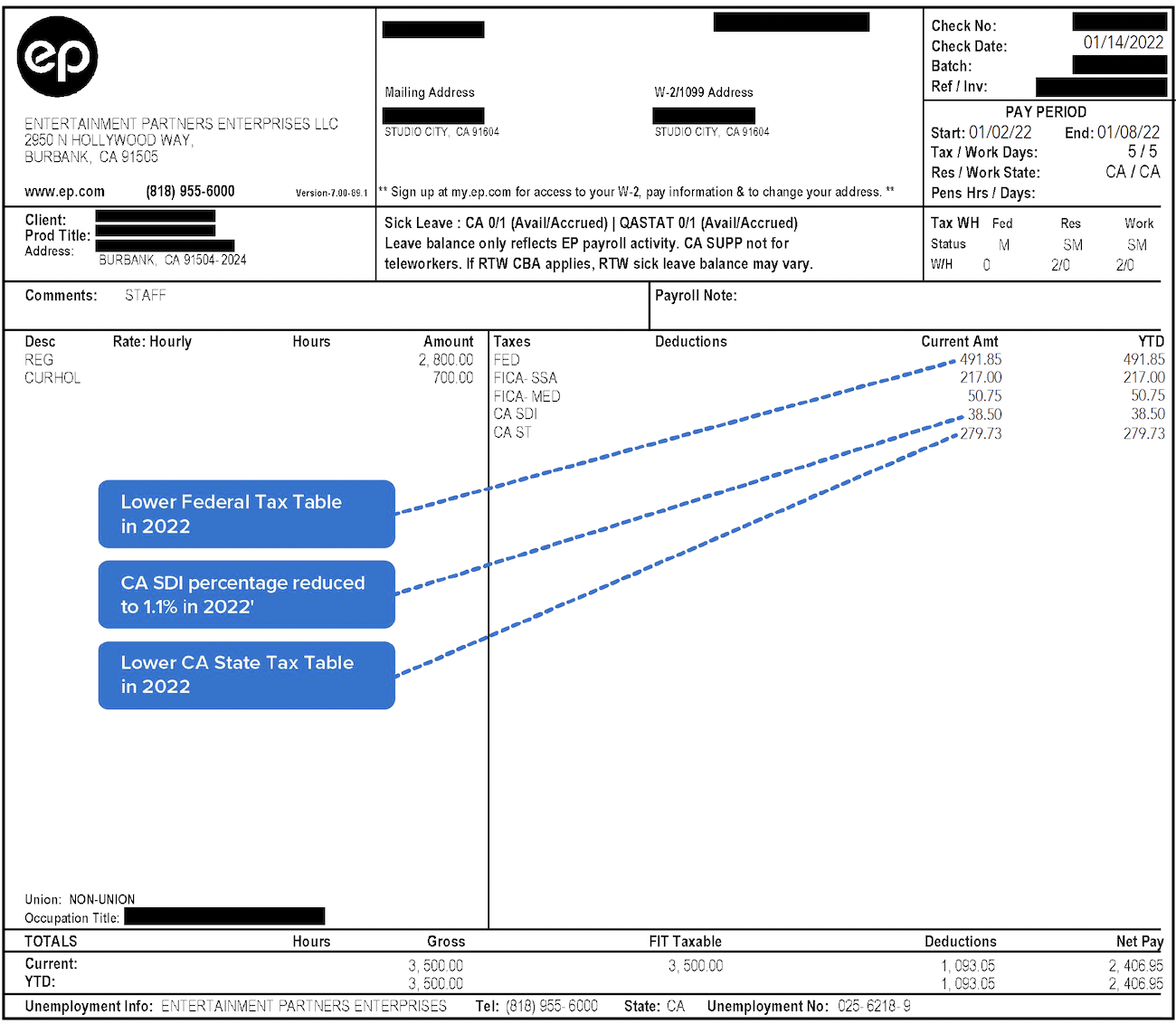

Decoding Your Paystub In 2022 Entertainment Partners

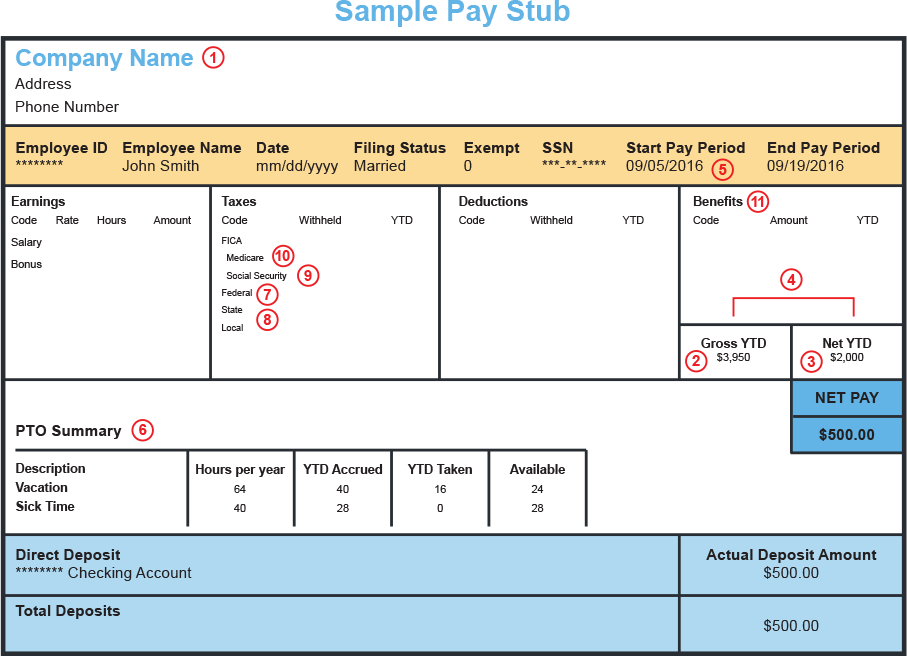

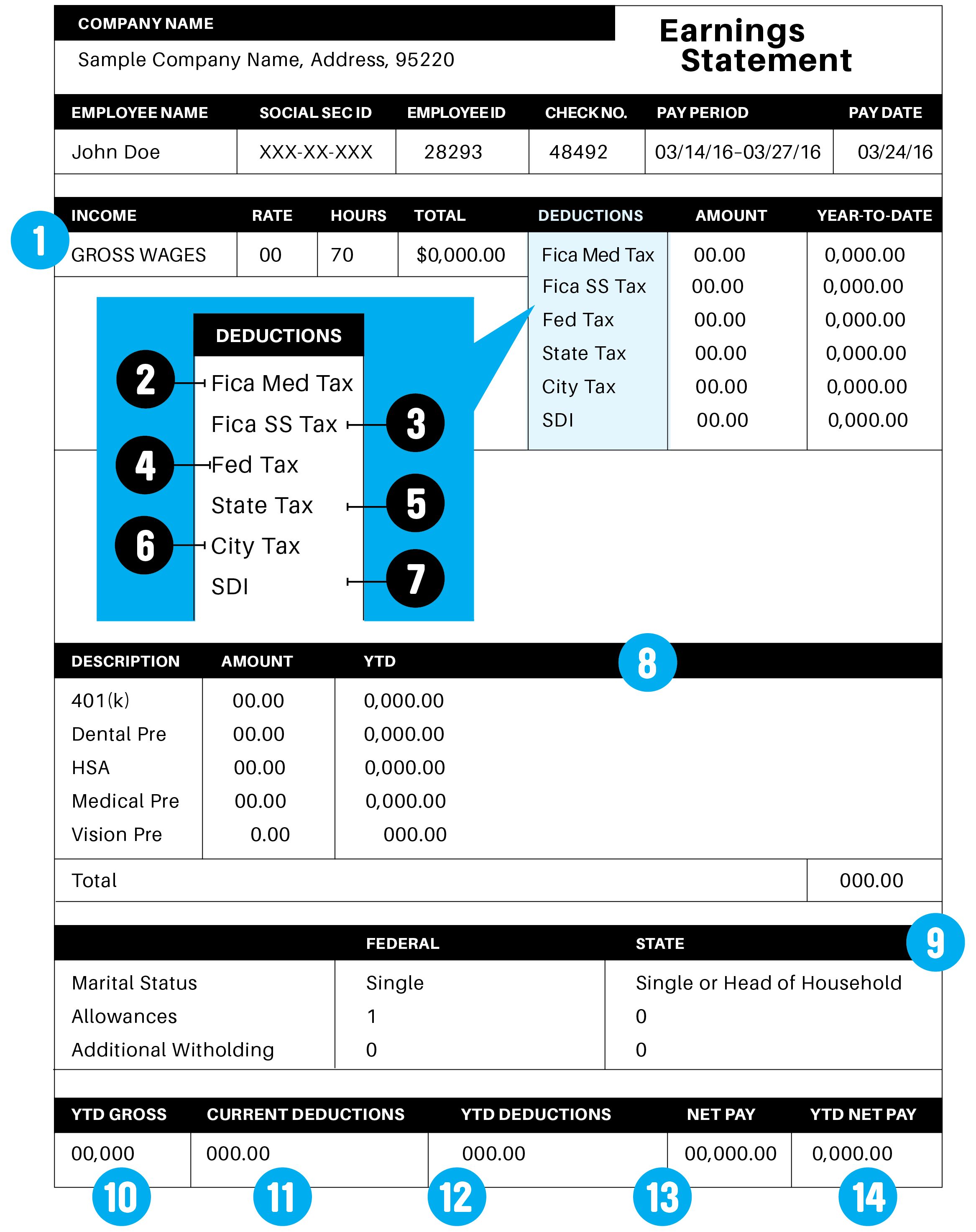

Understanding Your Paycheck

/payslip-172857080-0581fc5203d742cbaa52b248e8de2471.jpg)

Payroll Deduction Plan Definition

What Everything On Your Pay Stub Means Money

Why Your Paychecks Might Be Bigger Right Now Nextadvisor With Time

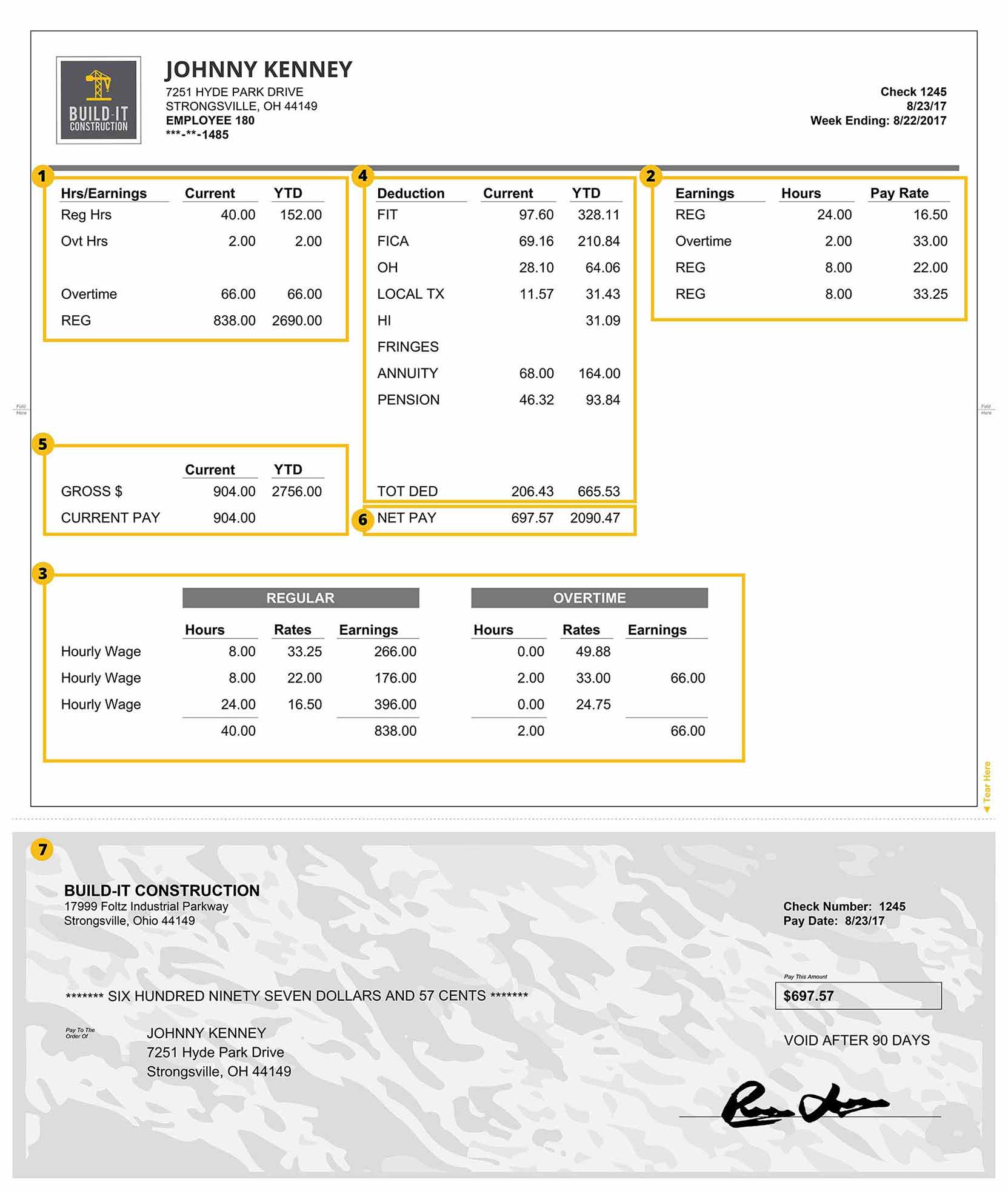

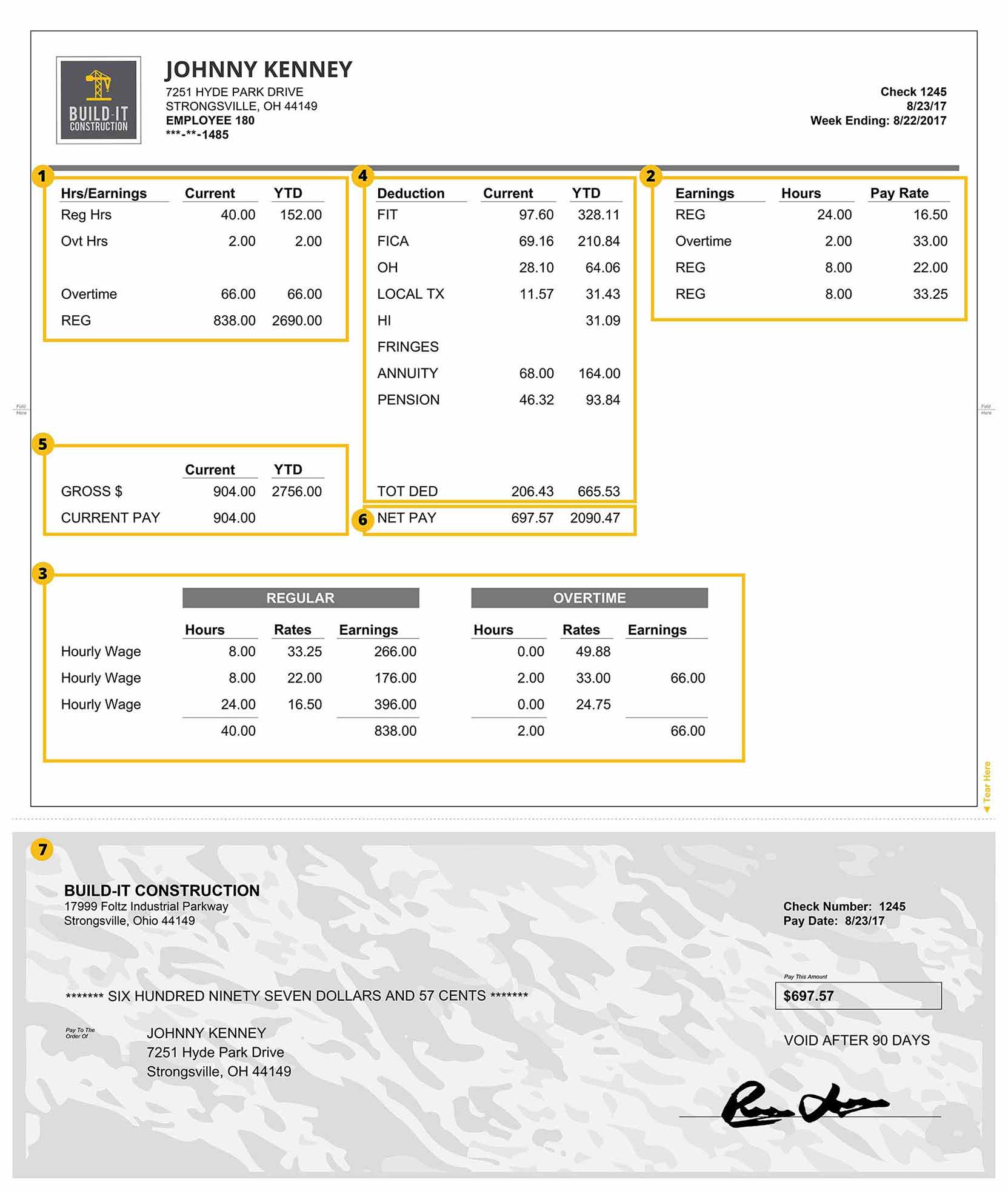

A Construction Pay Stub Explained Payroll4construction Com

Paycheck Calculator Online For Per Pay Period Create W 4

Understanding Your Paycheck Credit Com

Budget Percentages How To Spend Your Money Budgeting Budget Percentages Budgeting Money

The Measure Of A Plan